Retail went from bullish to ‘ultra bearish’ as Bitcoin dipped to $113K

Cointelegraph

2025-08-20 14:11:37

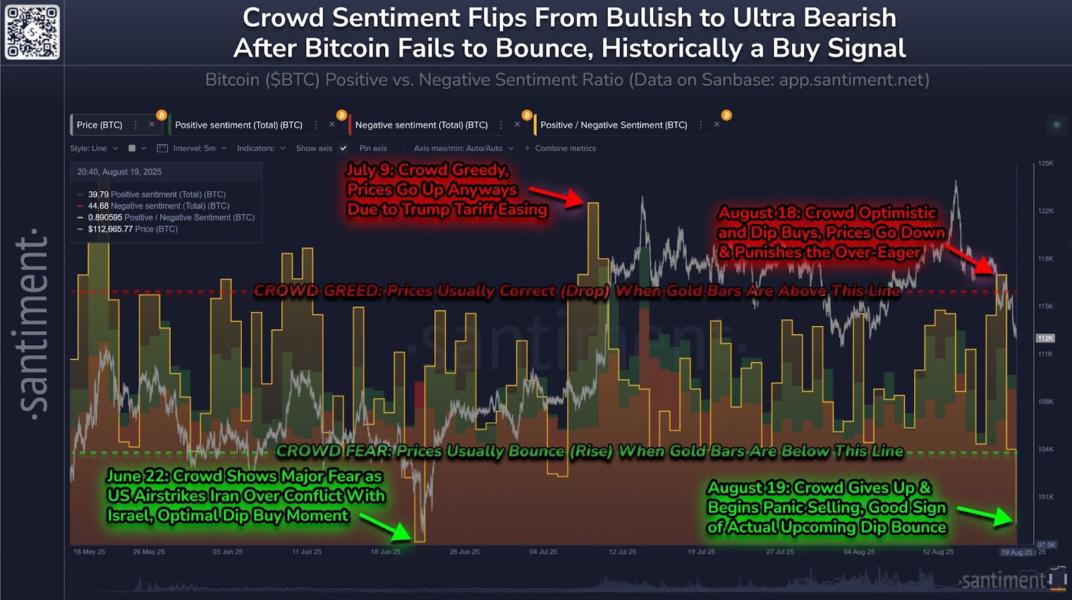

Retail crypto traders have seemingly flipped bearish after Bitcoin failed to pick itself up from a recent dip below $113,000, clocking a 17-day low.

“Retail traders have done a complete 180 after Bitcoin failed to rally and dipped below $113,000,” said analysts at blockchain analytics firm Santiment on Wednesday.

Santiment also reported that the past 24 hours have marked “the most bearish sentiment seen on social media” since June 22, when fears of war in the Middle East caused a cascade of panic sells.

However, Santiment said negative social sentiment is a good thing for dip buyers, especially when there is “blood in the streets and fear is maximized.”

Short-term retail traders are also more inclined to panic sell or scalp profits than their diamond-handed counterparts, who view the asset class as a longer-term investment.

Santiment said that the panic selling was a “good sign of an upcoming dip bounce.”

Bitcoin falls to support zone

Bitcoin fell to $112,656 in late trading on Tuesday on Coinbase, according to TradingView, its lowest price since Aug. 3 when it fell toward support levels at around $112,000.

BTC has now retreated by 8.5% from its all-time high last week of just over $124,000, while the total crypto market capitalization has dropped below $4 trillion to a two-week low.

Meanwhile, the Bitcoin Fear & Greed Index has slipped into “Fear” with a rating of 44 out of 100, its lowest level since late June.

“Markets move in the opposite direction of the crowd’s expectations,” said Santiment.

Will bull cycle history rhyme?

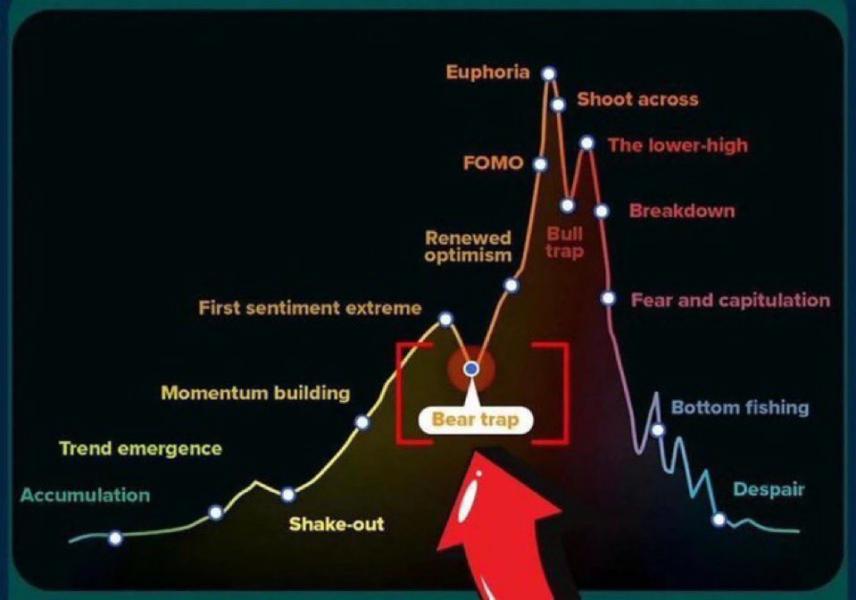

Market corrections during a bull cycle are nothing new and are a healthy part of the larger cycle. Similar pullbacks, often called “bear traps,” occurred at the same stage in the cycle in previous years.

In the 2017 bull market year, BTC corrected by 36% in September before surging to a new peak three months later.

A similar scenario played out in September 2021 when BTC corrected 23% before powering to an all-time high later that year.

If history rhymes and there is a similar correction depth in 2025, BTC could pull back as low as $90,000 next month before recovering to a new all-time high, if it follows the same pattern.

最新快訊

ChainCatcher

2025-08-25 03:39:06

ChainCatcher

2025-08-25 03:39:03

ChainCatcher

2025-08-25 03:38:04

ChainCatcher

2025-08-25 03:38:03

ChainCatcher

2025-08-25 03:36:03