Trump’s latest tariff overhaul squeezes US bitcoin miners as ASIC imports shift abroad, industry expert warns

The Block

2025-08-06 22:16:52

U.S. bitcoin miners are bracing for a slowdown in growth following the White House's move to impose steep reciprocal import tariffs on mining rigs from Southeast Asia, Luxor Technology Chief Operating Officer Ethan Vera told The Block.

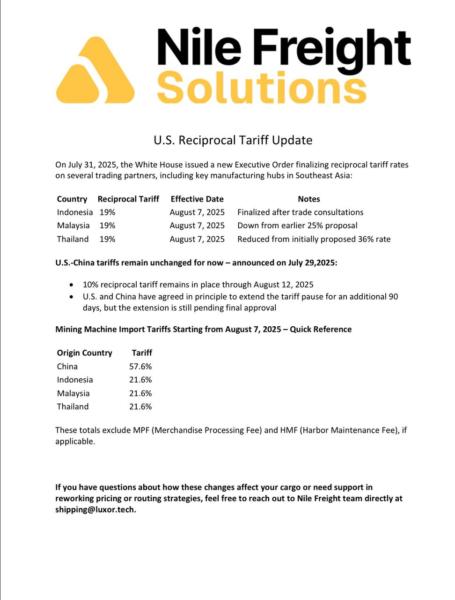

Following the expiration of President Trump's 90-day tariff pause announced during the "Liberation Day" trade overhaul in April, the White House finalized new reciprocal tariffs on key manufacturing hubs for mining rig production on July 31.

The latest rates, outlined in a

U.S. tariffs on China, another key hub, remain unchanged for now, as announced on July 29, the document confirms. A 10% baseline reciprocal tariff is in place through Aug. 12, plus an additional China‑specific premium of 20%, meaning that mining machine import tariffs on China currently stand at 57.6% in total — though that's still lower than the 145% rate floated at one point. The U.S. and China have agreed in principle to extend the tariff pause for a further 90 days, but that is still pending final approval.

While the rates have been reduced from earlier proposals, before Trump's second term, ASIC mining machines imported from Malaysia, Thailand, and Indonesia faced a standard U.S. import duty of around 2.6%. ASICs imported from China also fell under that 2.6% duty, but were subject to an additional 25% ad valorem rate of duty under Section 301 trade measures.

Luxor is a bitcoin mining technology and services company that operates mining pools, offers ASIC brokerage, custom firmware, and hashrate derivatives. Although the U.S. is its largest market, Luxor services mining companies in 32 countries. The firm's COO said the tariffs are already reducing demand from U.S. clients and shifting machine flows to countries with more favorable import regimes, such as Canada.

"We generally foresee a dampening in growth in the U.S. which will lead machines to head to overseas markets with more favorable import tariffs," Vera said. "At 21.6% tariffs, the U.S. is now one of the least competitive jurisdictions to bring machines in, and miners are looking at Canada and other markets to expand too."

In response, Luxor is helping clients secure machines through onshore manufacturing partnerships, including a domestic production deal with one of the leading Chinese rig makers, MicroBT. "We think that all the major ASIC manufacturers are actively expanding their capabilities to produce domestically to deliver machines to U.S. clients at affordable costs," Vera added.

Still, firms holding inventories of used miners in the U.S. could also come out ahead. "We think U.S.-based used ASIC machines will have strong price appreciation as they trade up 20% plus, which will be favorable to miners with existing fleets in the U.S.," the Luxor COO said, pointing to increased demand for locally sourced equipment as import barriers rise.

However, while Luxor's views echo those of many mining companies in the space, it also contrasts with those of Singapore-based public bitcoin miner BitFuFu. Luxor Chairman and CEO Leo Lu told The Block earlier this week that U.S.-based miners can leverage the country's relatively low-cost and increasingly renewable energy sources to maintain competitive operating margins, even if upfront equipment costs rise.

BitFuFu says it has built out local partnerships to optimize operations in states like Oklahoma, Texas, and Colorado — allowing it to absorb tariff impacts while expanding its U.S. presence, and other companies can do the same.

Weathering the impact of Trump's tariff policies

Despite Trump's embrace of crypto and desire to make the U.S. a "bitcoin mining powerhouse," companies in the industry have been rushing to adjust their short and long-term plans in an attempt to weather the impact of the president's tariff policies.

Trump's tariff announcements hit both traditional and crypto markets hard between February and early April, especially following Liberation Day, on April 2, when he laid out reciprocal import tariffs with a baseline of 10% and more than 50% in some cases. However, a 90-day tariff pause for most countries subsequently offered some relief.

Most bitcoin mining hardware is designed outside of the U.S., with the industry historically dominated by Antminer, a product line of China-based Bitmain Technologies. Therefore, raising import tariffs on the required equipment severely impacts the industry's bottom line and the share prices of publicly listed bitcoin mining firms in the country.

During the aftermath of those initial announcements, Vera told The Block in May that he expected Russia to be the main beneficiary of the tariffs if they were executed on the industry's supply chain in full, as the global mining hashpower landscape begins to reshape and U.S. growth decelerates.

This is principally as Russian mining firms will be able to procure machines for less, and China-based capital will increasingly flow in that direction, Vera explained, adding that capital providers from the U.S. and Europe would begin investing more heavily in Canada, Northern Europe, Ethiopia, Brazil, Argentina, Chile, and Paraguay.

Long-term tariff impact

Longer-term, Luxor is excited about the prospect of machines being produced in the U.S., but warned it could take years to fully onshore bitcoin mining equipment manufacturing.

"We think that final assembly in the U.S. is possible today, and many manufacturers are doing it," Vera said in May. "However, the raw materials and components largely come from Asia so the machines will still end up carrying a higher cost. For a machine to be produced mostly from components sourced from the U.S., we expect it will take at least a few years before that is at scale."

Regarding what action Luxor would like to see the Trump administration take next, it continues to push for bitcoin mining ASICs to receive an exemption similar to HTSUS 8471 on certain imports of computers, laptops, and servers.

"We think it's important given the administration's campaign stance on helping the domestic industry and improving the mining industry in the U.S.," Vera said, adding that the firm is engaged with several groups advocating for fair treatment of bitcoin miners in the U.S.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

最新快訊

ChainCatcher

2025-08-18 04:10:10

ChainCatcher

2025-08-18 02:03:24

ChainCatcher

2025-08-18 02:03:23

ChainCatcher

2025-08-18 00:17:01

ChainCatcher

2025-08-18 00:17:00