'Don't get trapped!' Bitcoin price analysis sees dip with $118.8K in focus

Cointelegraph

2025-07-14 23:05:28

Key points:

Bitcoin surfs exchange order-book liquidity as huge gains plateau at around $120,000.

Bid support suggests a return below $119,000 next as part of an anticipated retest.

One trader warns of a potential “pump and dump” ploy to trap late buyers at higher levels.

Bitcoin consolidated gains at the Monday Wall Street open as analysts braced for a BTC price correction.

BTC price cools amid “rug pull” warning

Data from Cointelegraph Markets Pro and TradingView showed circling $121,000 as the week’s first US trading session began.

New all-time highs near $123,250 had capped a blistering rally earlier today, with Bitcoin still up over 10% in a week.

While many expected the market to pause for breath after such rapid upside, trading resource Material Indicators was cautious.

“Don't get trapped!” it warned followers in its latest post on X.

“That $BTC buy wall at $120.5k seems like it may be there to lure in late longs before a support test.”

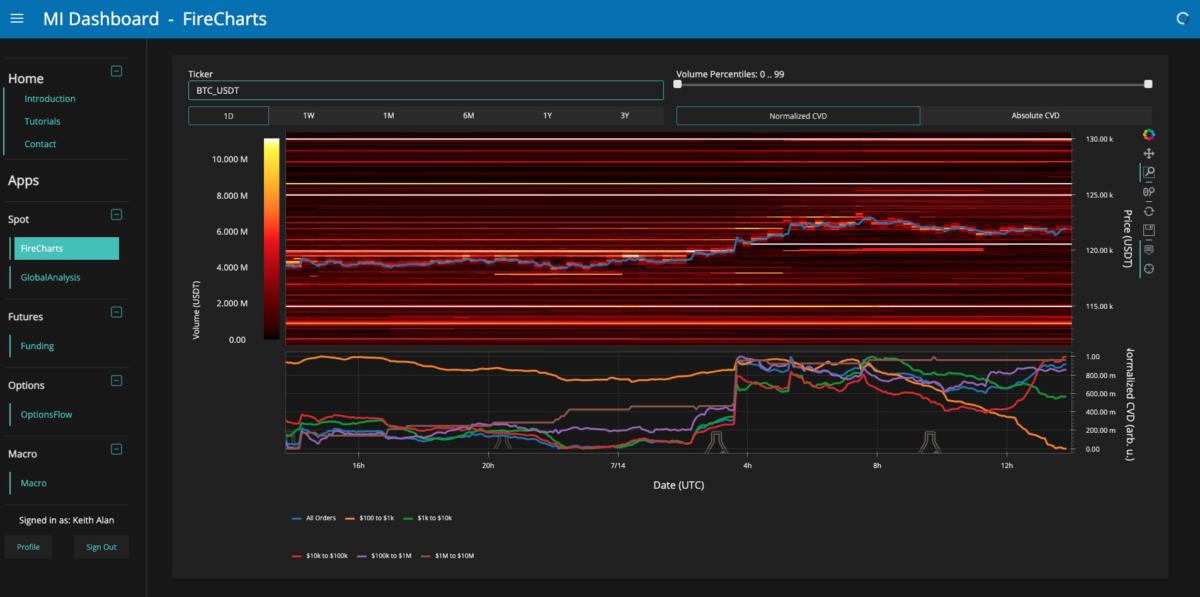

An accompanying chart showed order-book liquidity for the trading pair on largest global exchange Binance.

“Watch out for a rug pull if price gets close,” Material Indicators added.

“The cycle top is not in yet, but there should be a support test before a sustainable run through $130k.”As Cointelegraph reported, order-book liquidity manipulation has played a key role in short-term BTC price action in recent months, with large-volume traders shifting bids and asks around to attract price in a certain direction.

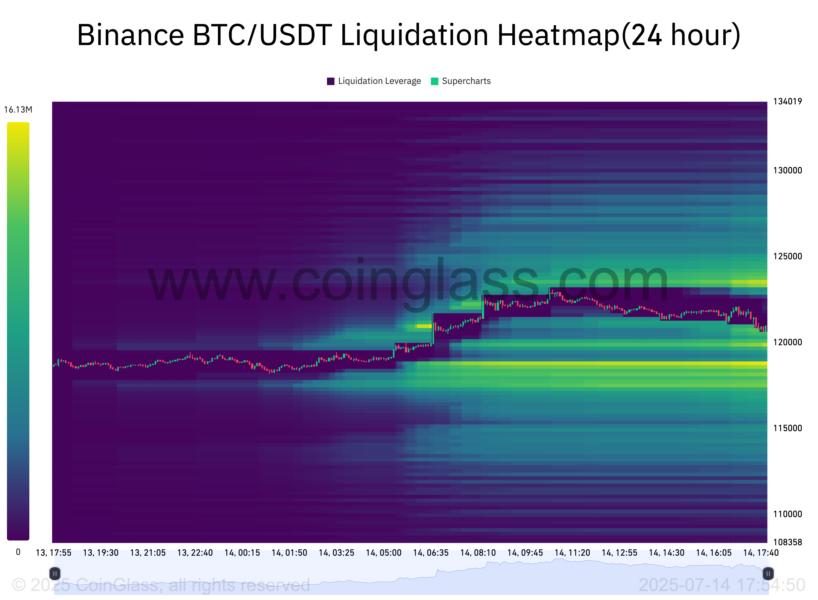

The latest data from CoinGlass on the day highlighted key support beginning at $118,800, leaving the door open for a roughly 2% correction next.

Total BTC short liquidations in the 24 hours to the time of writing were $432 million.

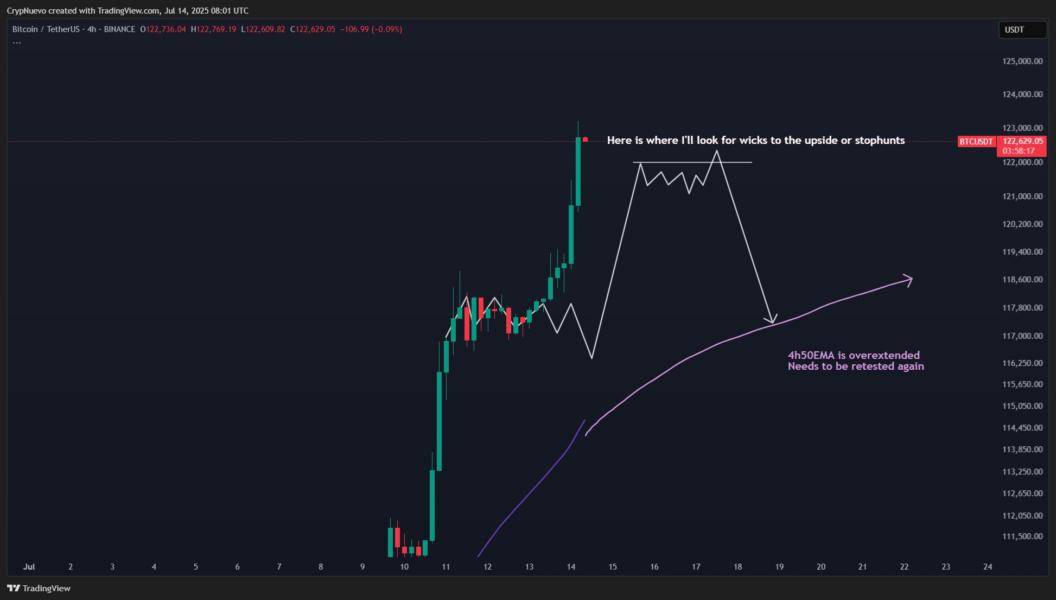

“We need to be aware of more manipulation,” popular trader CrypNuevo continued in his own X analysis on the day.

“This could also be part of a pump-and-dump weekly pattern. Caution.”

Pro traders stay “selective” at $120,000

Amid a lack of classic signs of “FOMO,” trading firm QCP Capital saw ground for continued optimism.

“This could reflect a maturing market dynamic, and the same could be said for ETH,” it wrote in its latest bulletin to Telegram channel subscribers.

“Another consideration is that traders may be opting to express directional views through perpetuals rather than options, given the elevated cost of optionality in fast-moving markets.”QCP suggested that traders may wish to hedge against low-timeframe volatility “while maintaining a longer-term bullish outlook.”

“We maintain our structurally bullish view on BTC, underpinned by continued institutional inflows and macro tailwinds,” it concluded.

“However, at current levels, we prefer to be selective and are holding back from chasing the rally in favour of positioning on a pullback, should it occur.”📈 BULLISH: Anthony Pompliano calls Bitcoin the “Greatest Show on Wall Street” as ETFs, treasuries, retail and sovereign funds pile in at all-time highs. pic.twitter.com/RdTE3Po49r

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

最新快訊

ChainCatcher

2025-07-18 13:08:50

ChainCatcher

2025-07-18 12:47:52

ChainCatcher

2025-07-18 12:47:32

ChainCatcher

2025-07-18 12:44:31

ChainCatcher

2025-07-18 12:33:33