Crypto investment products log second-largest weekly inflows of $3.7 billion amid bitcoin all-time high rally: CoinShares

The Block

2025-07-14 17:21:11

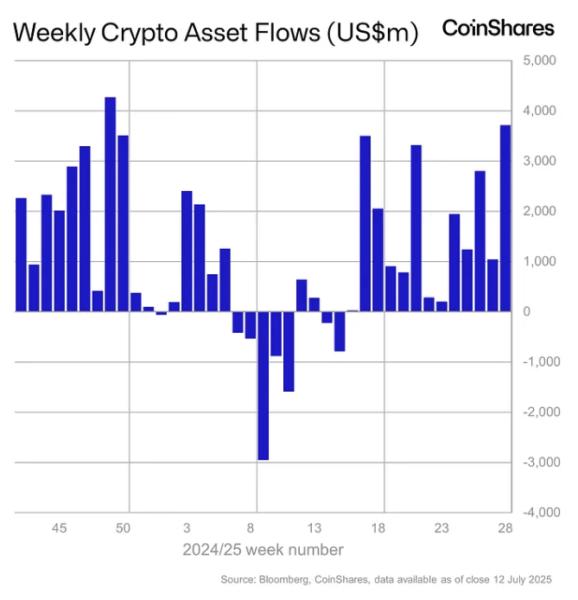

Crypto investment products managed by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares recorded another $3.7 billion in net inflows globally last week, according to CoinShares data.

The figure represents the second-largest weekly inflows on record after the $3.9 billion added in early December. Alongside the ongoing crypto rally as bitcoin continues its all-time high run, the inflows take total assets under management at the funds to a record $211 billion, CoinShares Head of Research James Butterfill noted in a Monday report — exceeding the $200 billion mark for the first time. "Notably, July 10 recorded the third-highest daily inflow ever," he added.

It marks the 13th consecutive week of net inflows for global crypto funds, totaling $21.8 billion, and brings year-to-date inflows to a new high of $22.7 billion. Trading volumes also reached $29 billion last week — twice this year's weekly average — Butterfill noted.

Weekly crypto asset flows. Images: CoinShares.

Bitcoin and Ethereum products dominate amid mixed regional flows

Regionally, the U.S. led with net inflows of $3.7 billion, followed by Switzerland and Canada crypto investment products, with $65.8 million and $17.1 million, respectively. However, this was offset by net outflows of $85.7 million, $15.7 million, and $7.5 million from funds in Germany, Sweden, and Brazil.

Bitcoin-based funds registered their fifth consecutive positive week, accounting for 73% of the net inflows, adding $2.7 billion, and driving their AUM to $179.5 billion. "For the first time, this equals 54% of the total AUM held in gold ETPs," Butterfill highlighted. In contrast, short-bitcoin investment products showed minimal activity.

The U.S. spot Bitcoin ETFs accounted for the majority of that figure, attracting $2.72 billion last week, according to data compiled by The Block, offset by outflows from other regions.

Meanwhile, Ethereum-based funds added another $990 million — the fourth largest on record — to post their 12th consecutive week of inflows — the longest streak of inflows since mid-2021. "In relative terms, Ethereum’s inflows over the past 12 weeks account for 19.5% of its AuM, compared to 9.8% for Bitcoin," Butterfill said.

The U.S. spot Ethereum ETFs also dominated this figure, accounting for $908.1 million of last week's inflows.

In terms of other altcoin-based investment products, Solana funds recorded the next highest weekly inflows of $92.6 million, while XRP products saw the largest outflows, totaling $104 million.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

最新快訊

ChainCatcher

2025-07-18 23:01:12

ChainCatcher

2025-07-18 22:59:19

ChainCatcher

2025-07-18 22:56:04

ChainCatcher

2025-07-18 22:54:33

ChainCatcher

2025-07-18 22:40:37