BoA exploring stablecoins to help move trillions in client transactions, CEO says

Cointelegraph

2025-07-17 00:42:12

Bank of America is in the early stages of exploring stablecoins, aiming to leverage blockchain technology to enhance its payment infrastructure.

During the bank’s second-quarter earnings call, CEO Brian Moynihan addressed questions about BoA’s stablecoin strategy, noting that the initial focus is “on stablecoins as a transactional device.”

Stablecoin-based payment rails could help BoA move the trillions of dollars in client assets that flow through its systems each day.

“We believe that if they want to use stablecoins to move part of that money, they’ll move,” Moynihan said, referring to stablecoin systems that move US dollars and euros.

“We’ve done a lot of work. We’re still trying to figure out how big or small it is because of some of the places are not big amounts of money movement. So you’d expect us all to move,” he said.

BoA has been actively exploring stablecoin use since at least early 2025, with Moynihan saying at a conference in May that the bank would move forward if supportive legislation is enacted. The bank has reportedly considered issuing a stablecoin jointly with other banking giants, such as JPMorgan and Citigroup.

BoA reported mixed financial results in the second quarter. Net income climbed 3% to $7.12 billion, exceeding forecasts, while revenue rose roughly 4% to $26.61 billion, falling slightly short of expectations.

Stablecoin market accelerates as GENIUS Act hits a snag

The stablecoin market is growing rapidly, with industry observers increasingly viewing fiat-pegged assets as the emerging “default settlement layer” for the internet. As Cointelegraph reported, stablecoin transaction volumes surpassed those of Visa and Mastercard combined in 2024.

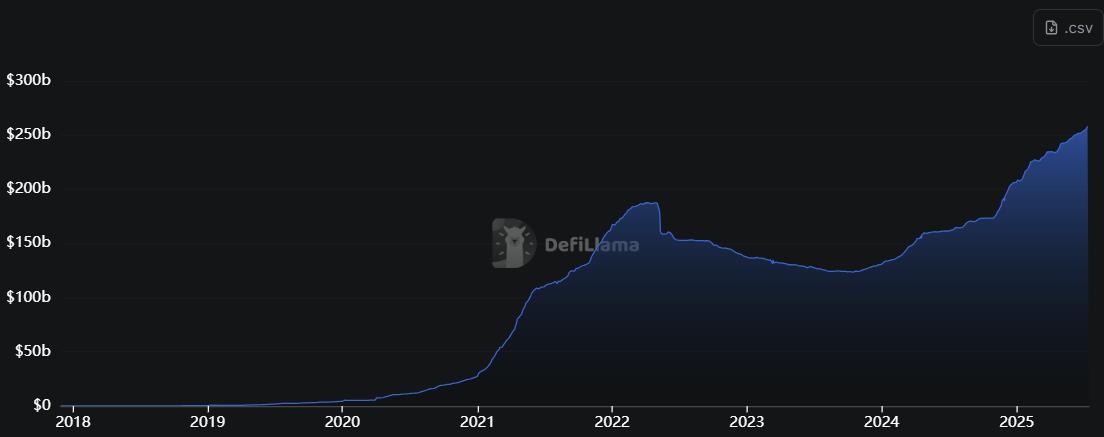

Since then, the total value of stablecoins in circulation has surged to $257 billion, nearly double the amount at the beginning of 2023. Tether’s USDt (USDT) and Circle’s USDC (USDC) account for more than 85% of the stablecoin market combined.

The growing opportunity has prompted the administration of US President Donald Trump to make stablecoin legislation a priority, chief among them being the GENIUS Act.

Although the bill gained bipartisan support in the Senate Banking Committee and passed the Senate in June, it, along with other crypto measures, stalled in the House of Representatives after a group of lawmakers blocked a key procedural vote on Tuesday.

The GENIUS Act is expected to go to a floor vote in the House by Thursday.

最新快訊

ChainCatcher

2025-07-20 11:49:35

ChainCatcher

2025-07-20 11:41:16

ChainCatcher

2025-07-20 11:35:29

ChainCatcher

2025-07-20 11:31:05

ChainCatcher

2025-07-20 11:01:13